The importance of time frame continuity with AAPL

Turned a profitable day into a losing day by losing sight of time frame continuity- Sized up on trade C. with 2 options trade. Trades A and B both profitable options trade.

A short setup to add to my Playbook:

Short covering off bottom, inside 5 makes a lower high and in the top 1/3 of large green candle. Short break of inside 5

TraderEric

Friday, June 21, 2013

Thursday, June 13, 2013

Bad Trading Day

ULTA had a huge gap up move yesterday, but closed very weak. The stock opened lower this morning and I was looking for a move lower. My bias was short, and failed to pay attention to what the tape was telling me.

1. First short entry is one of my favorite trades. Look for an inside 5 minute bar after a large initial move and look for a break of the inside 5 (ideally in the original direction). Good trade, got stopped out before the big drop.

2. Looked to enter long, which was the play for today. Entered on break of inside 5 minute bar, but was distracted (at work and sold the position). This would have held up all day long as the stop price was never breached.

3. Looking short again on break of inside 5 minute bar, again stock was too strong and stopped out. This should have been a clear indication that the tape was looking higher - Higher lows being put in, and shorts quickly stopped out.

RULE BREAK.

One of my rules is that I am done trading if I have 3 losing trades in a row. I had a loss of $49 for the day.

4. Looked long as my short was stopped out. I was looking long as a my stop was at the break of an inside 15 minute bar ($95.87). Entered @ $95.91 with a stop at $95.73. Instead of following the strategy, I decided to exit the position (fear) and stopped out @ $95.85. The trade would never have stopped out and continued to 97.50

5. Rule break 3 & 4

Shorted break of shooting star with 3x size. Quickly stopped out. Loss for the day - $189

Lessons learned today.

Follow the strategy, especially where to place the stops.

Don't break my trading rules.

OK to have a bias but watch the tape

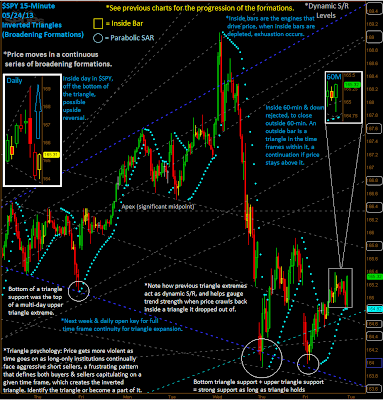

Saturday, May 25, 2013

Friday, May 24, 2013

Thursday, April 25, 2013

Saturday, July 28, 2012

Saturday, April 28, 2012

Shorting Rounded Tops

Played MDRX on the long side than the short side today. MDRX had negative news on earnings and had a huge gap down. GMAN said that the stock was holding the $9 level. My entry was @ 9.25. The price was above the 9EMA and 20 SMA and flagging. Sold a quick 1/2 @ 9.50, and 1/4 @ 9.82. I added another position when the stock broke the HOD @ 9.87. Sold a quick 1/2 @ 10. I meant to place my Stop @ 9.85 but placed it @ 9.90 (ITrade's new platform sucks) and got wicked out, or I could have enjoyed the nice run to 10.50!!

The stock topped out @ 10.51 and started forming a rounded top. I shorted at 10.32 (previous level) for a quick gain. 1/2 @ 10.12 and 1/2 @ 10.28. Once the price action broke above 10.24, the trade had reversed and exited. It made a lower high and came back to the same level. I shorted at 10.29 this time, but there was no follow through and exited for scratch.

Here are the 1 minute and 5 minute charts. I saw the trade much better on the 1 minute chart.

I noticed the rounded top as a result of a conversation I had with my buddy @Ktrades this week as we were discussing price action. Thanks!!!

The stock topped out @ 10.51 and started forming a rounded top. I shorted at 10.32 (previous level) for a quick gain. 1/2 @ 10.12 and 1/2 @ 10.28. Once the price action broke above 10.24, the trade had reversed and exited. It made a lower high and came back to the same level. I shorted at 10.29 this time, but there was no follow through and exited for scratch.

Here are the 1 minute and 5 minute charts. I saw the trade much better on the 1 minute chart.

Subscribe to:

Comments (Atom)