Context Matters: Why BIDU was a short and CF was not

Last week I wrote a blog that discussed an excellent short setup in BIDU from May 16th. BIDU was trending down on the daily time frame and offered a very low risk intraday trade on the short side after running up on the Open and then forming a rounded top. I tasked one of our trainees to continue to look for similar setups and to execute when she found these trading opportunities.

Today, while broadcasting live on StockTwits.tv I received a question regarding a trade in CF one of our trainees was considering making. He thought that CF presented a good shorting opportunity with a very small clearly defined amount of risk with 1 to 2 points of upside. I wondered if my discussion of the BIDU short had influenced him to think that CF offered a good shorting opportunity as well. Similarly to BIDU last week CF had a powerful up move on the Open then began to move sideways. That is roughly where the similarity ends.

My response on stocktwits.tv regarding this setup can be found here at the 21:30 mark of the video. CF unlike BIDU was not in a downtrend on the daily time frame. It also had just broken above the highs from the prior two trading sessions. And this strength was being exhibited on a day when the market was down over 1%. This was a stock that was trending higher on virtually all time frames. This stock was a long.

In law school one of the common techniques used on exams is to make small changes in fact patterns and then ask students how these changes would alter their conclusions. If you are attempting to be a professional intraday trader I would suggest that you employ this technique to help sharpen your trading skills. When reviewing your work make subtle changes in the conditions that you encountered when examining a stock for a potential trade. How would these changes impact your conclusions?

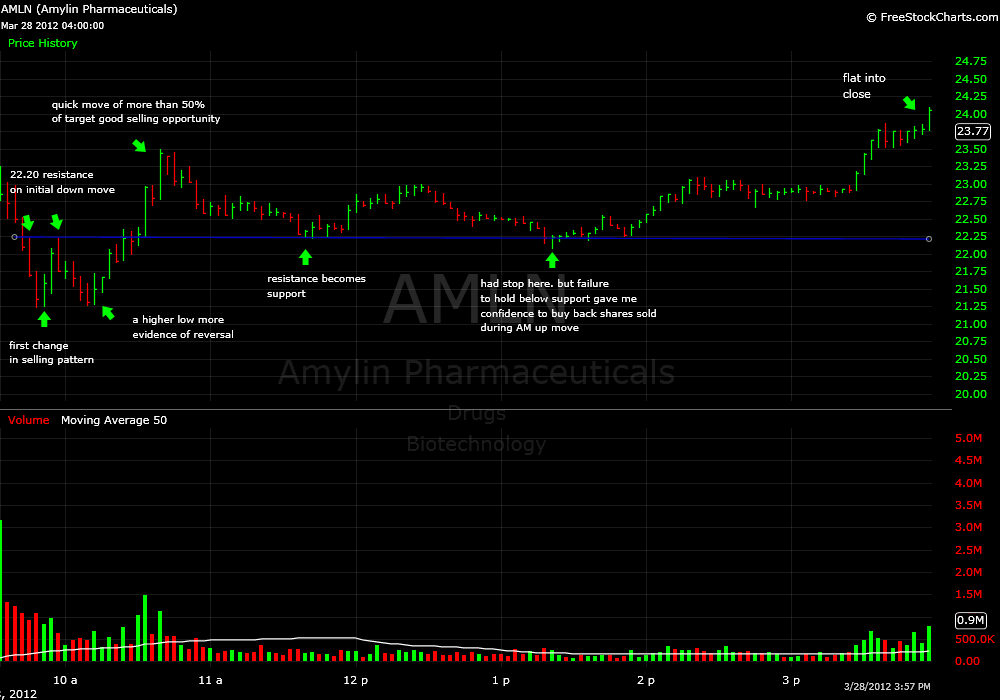

CF and BIDU charts for your review:

I loved the AMLN Second Day Play near 23, an important level from yesterday. Yesterday AMLN was In Play, could not get above 23, and then did with a nice push in the closing hour. A pullback to near 23 was an A+ Second Day Play. I placed a bid at 23.03 and just missed a fill. AMLN touched every price save my bid. I had that feeling that I am not a part of the market place. Later I bought 23.38 and am just holding now.